Youth Money Management Lessons: Where to Begin

Interested in creating a youth money management program, but don’t know where to start? You’ve reached a good launching point to get financial literacy programs for youth off the ground. This website is designed to support people who want to deliver youth money management instruction by presenting topics of value and discussing the financial obstacles kids must tackle.

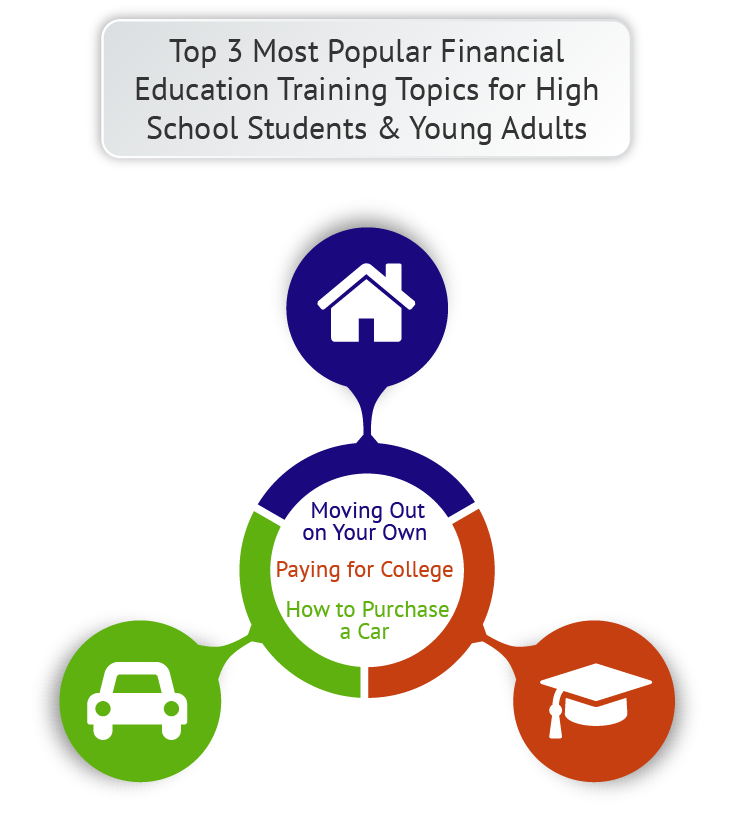

Valuable Subject Matter for Teens

Teens will receive greatest benefit from youth money management lessons that address the topics that are unique to young adults’ decision-making. Three cases in point include vehicle purchasing, educational funding, and independent living.

Buying a vehicle involves a series of money management practices: setting objectives; budgeting for the car (including all expenses of ownership, beyond just the loan payment); qualifying for a loan; obtaining credit; and choosing an appropriate insurance policy. Workshops that address these subjects will attract young participants who are eager to learn.

How to pay for university is a second key topic for teenagers. Such a seminar might guide youth through the processes of selecting career options, calculating educational ROI, developing a college budget, and various funding streams such as student loans, grants, and scholarships.

Lastly, independent living represents an important subject that many young people will be interested to study in a personal finance class for high school levels. By “independent living,” we mean gaining the knowledge and skill to set personal finance goals, create a budget, rent or buy a house/apartment, and categorize all the expenses of independent life (rent, transportation, insurance, food, utilities, etc.).

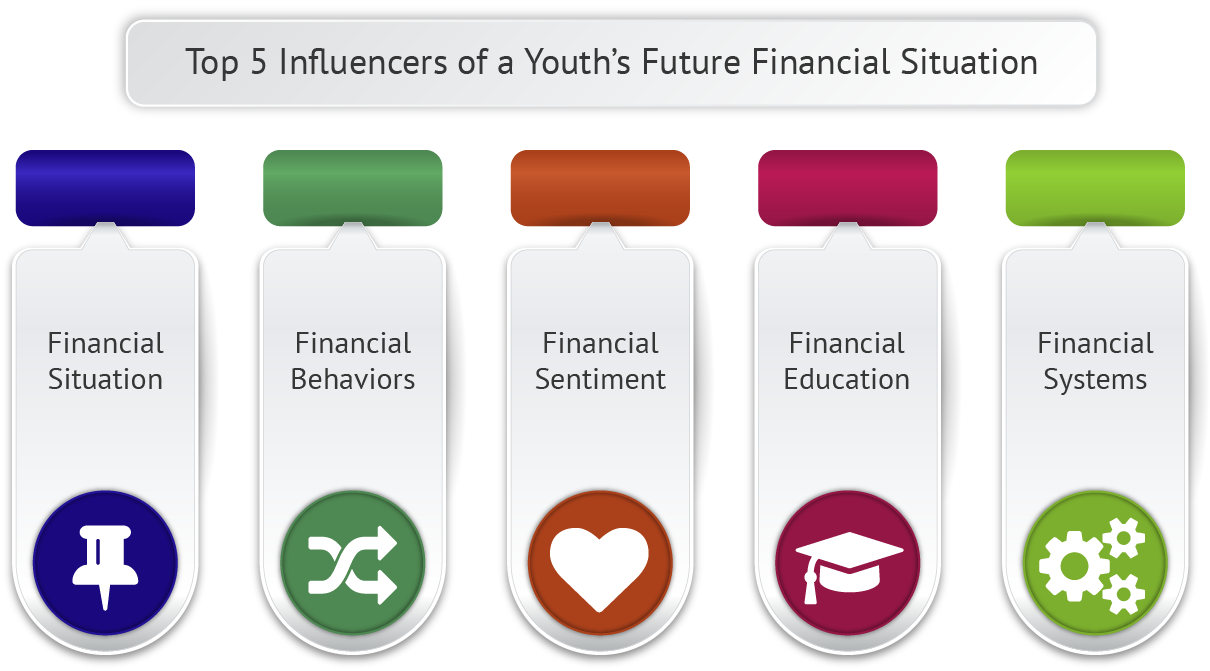

Features that will Influence Youth Money Management in the Future

Five essential features will influence teens to adopt certain youth money management habits: their family situations, behavior patterns, money sentiments, financial education exposure, and money management systems. Financial literacy for youth programming should address all those issues.

Financial Situation: this term refers to the socioeconomic conditions into which a child is born. What is the parents’ SES level? How good are they at managing their finances? What are the child’s opportunities for upward mobility?

Financial Behavior Development: youth money management behaviors start emerging when the kids are very young. Lots of factors affect their habits including advertising exposure, peer influences, parental modeling, and the environmental conditions.

Financial Sentiment: this phrase defines the feelings and emotions people have toward money. In youth money management, kids’ financial futures will depend on the attitudes and beliefs they start forming in childhood and carry forward into adulthood. This sentiment includes how capable they believe they are at managing their funds. Emotions should be a fundamental component of financial literacy classes in high school and college.

Financial Education: how much exposure youth have to solid money management education makes a huge difference in their personal finance futures. Yet very few schools and parents are preparing teens for an independent existence.

Money Management Systems: this term expresses the support and structures youth need to set themselves up for financial success. In other words, they need bank accounts, retirement savings, and tracking schedules in place to guide their personal finance decision-making.

Check out this page from You4Youth, sponsored by the US Department of Education, for more resources: You For Youth // Financial Literacy for All (ed.gov).