What is a Financial Consultant and Where Can I Find One?

“What is a financial consultant?” Many people ask. The answer is here – a national network of top-qualified consultants available through the NFEC who help people meet their personal finance objectives. The NFEC’s Certified Personal Financial Wellness Consultants have proven track records, meet the highest level of industry standards, and feel passionate about guiding others to improve their personal financial situations. Their main goals are to thoroughly explore your financial profile, define your goals and priorities, and outline action steps to move you toward greater financial security and wellbeing.

Read More

What is a Financial Consultant’s Standard for Qualifications?

Anyone can describe him or herself as a financial consultant. NFEC Certified Personal Financial Wellness Consultants stand out from the crowd because they meet top-notch qualifications in terms of educational, experiential, and personal background. These personal finance consultants must pass hundreds of educational hours, demanding tests, and strict background checks; and have demonstrated their implementation and performance skill through supervised consultation. The financial consultant standards came from industries of financial education/education, counseling/psychology, and financial/consumer protection. We chose these fields because financial consultants deal with money issues – an emotional topic. The consultant must determine clients’ needs and objectives, then offer support, education, and accountability to guide people toward financial health.

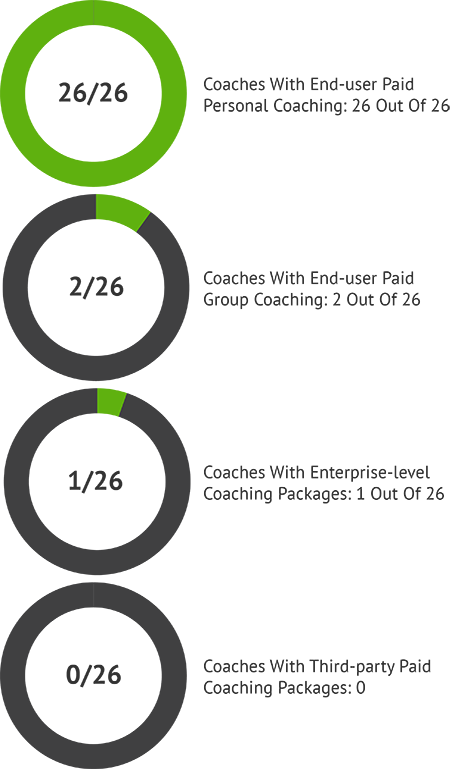

What is a Financial Consultant’s Average Offering?

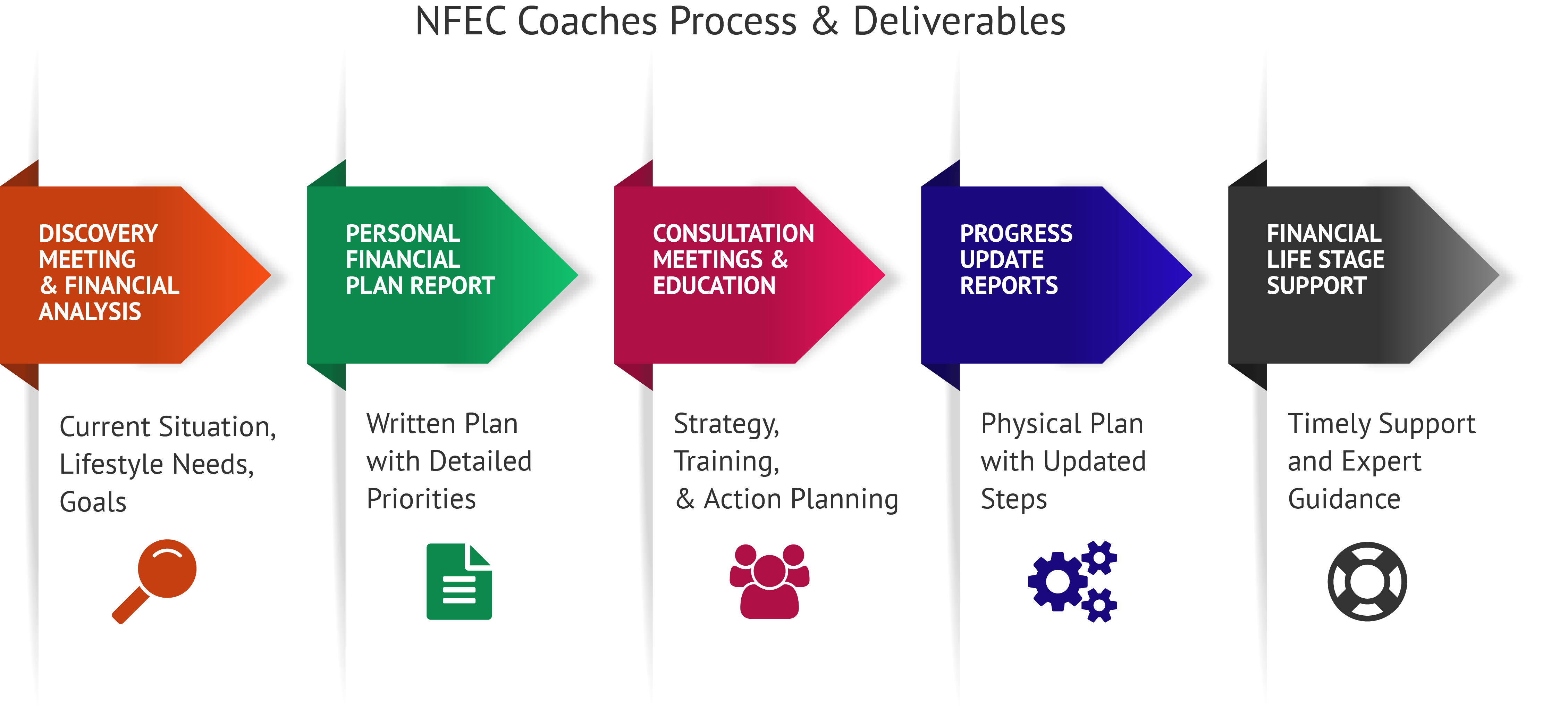

The average financial consultant does a number of activities geared to helping people improve their financial situation. They offer people direct contact and the opportunity to talk about money. Consultants from the NFEC network – by comparison – offer a wide array of services, each of which helps people improve their financial situations. Through systematic research, we gathered data from Google using the search terms ‘financial counseling’ and ‘financial coaching’ – 137 webpages appeared in the top 50 results pages. Out of those, 26 listed easy-to-find package and price data. We learned that direct consultant contact was the top average offering, followed by educational resources, personal financial planning, and re-reporting/re-planning. See below for a summary of NFEC deliverables.

Phase 1: Understanding & Planning

What does a financial consultant do? Jessica recently asked this question and found out that, when you choose an NFEC consultant, the process occurs in phases. At Phase 1 the consultant conducts a full financial profile analysis. The consultant reviewed Jessica’s bank accounts, credit, assets, income, liabilities, insurance, and any other relevant documentation. After the analysis was complete, the consultant understood Jessica’s financial health, goals, lifestyle, and sentiment toward money. Then Jessica received her personalized Financial Plan Report from a certified financial coach with detailed priorities and action steps.

Phase 2: Guidance & Education

Part 2 of answering the question, “What does a financial consultant do?” refers to consultation and education. For example, building on regular meetings and conversations with her consultant, Jessica received an educational package and personalized training from her financial coach that helped her gain key skills to make financial decisions aligned with her goals. Jessica kept her consultant abreast of changes to her situation, so she could update Jessica’s strategy over time.

Phase 3: Maintenance & Support

Jessica had met her immediate priorities and had a clear plan toward accomplishing her longer-term goals. Now the consultant’s role was support and maintenance. Jessica received timely reminders about specific dates, and the consultant stood by to guide and provide resources whenever Jessica needed support.

Connection with Niche Financial Industry Experts

At the next level, an NFEC financial consultant can connect clients with support from industry experts with specialized skills and knowledge. Say you’re buying your first home or planning for another large purchase – these experts provide the specific guidance you need. And all our personal finance industry experts have 100% responsibility to you. They are completely independent, so rest assured that no financial products will be marketed or sold.