Money Management Activities for College Students Make a World of Difference

If you’re trying to find engaging money management activities for college students, look no further. Peruse through the different resources we provide, and you’ll discover customizable solutions for any audience.

The National Financial Educators Council’s (NFEC) Curriculum Advisory Board creates lesson plans in personal finance that are based in solid theory and can be directly applied to the real world. Our certified instructors relate to students from any background. Our financial education programs will inspire you and your class to change your financial behavior for the better.

Designing Your Own Money Management Activities for College Students

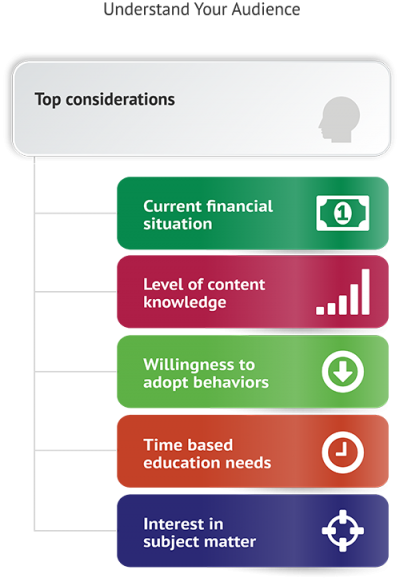

Anne, an associate professor at a community college, wanted to help college students become financially literate. She knew her audience consisted of lower-middle class late teens, but she needed to see if they’d be interested. She surveyed as many students as she could and found out that if she offered a course, they would take it.

Now she needed guidance in creating and launching such a program. A few of her fellow professors mentioned the NFEC, so she looked into it. Much to her delight, she found that they offered exactly what she needed. Now she could begin.

Defining the Desired Depth of Financial Literacy

According to the NFEC, Anne’s first step was to define the depth of knowledge she wanted her students to walk away with. She wanted them to think strategically about the basics of budgeting and debt. If they only had time to understand the concepts and skills necessary for a healthy financial life, they would still be way ahead of the curve. Her overall goal was to give them a good understanding of basic money management matters so they could apply them in the real world.

Delivery Considerations for College Money Management Activities

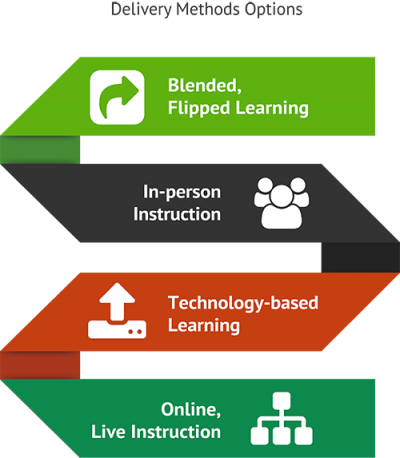

With the depth of understanding defined, Anne’s next step was to figure out the best way to deliver the activities. Experience told her that community college students wanted freedom from the structure of a classroom. She decided that a self-paced program based on achievement would offer them the independence they wanted. The money management activities for college students would be presented online, available on-demand, when the students were ready for them. A certified presenter would be available once per week for live office hours.

Areas of Focus for College Money Management Activities

What topics of personal finance did Anne want to address? The money management activities for college students had to apply to the students’ immediate situation and form good money habits that would stick with them throughout their lives.

Budgeting, debt and career planning were of primary importance. Anne decided to focus on these critical skills, so she could reach her already-defined depth of knowledge.

Critical Components of a College Financial Curriculum

Anne knew what her curriculum needed. It had to meet established core financial education standards. The money management activities for college students needed to be relatable to their every day lives and highlight specific actions to take for their situations. It had to accommodate a flexible schedule while also providing sufficient scaffolding to keep the students progressing at a healthy rate.

Finding a Certified College Finance Instructor

Anne considered what she wanted in a presenter. The person had to be a Certified Financial Education Instructor (CFEI) with experience teaching financial literacy activities to college students. The instructor had to be relatable, make a personal connection and be available for office hours. The needed to know how to teach money management lessons that would engage the students. The NFEC directed her to the perfect person. Now the foundation was complete. If the course went well, Anne would consider getting her own certification.

Money Management Activities for College Students Get Results

When all was said and done with the money management workshop, 31 college students registered for the programming activities. 27 completed it. 87% completion was more than Anne had hoped for. They all expressed an interest in learning more about personal finance.

Anne needed a report showing off the success, which she could present to potential investors. She also wanted to show the positive results to other community colleges in the hopes of expanding her college financial literacy program. To that end, she compiled the data from her program and created the report.

Financial Literacy Activity Growth Plans

The community college acknowledged the students who had volunteered for the personal finance activities by mentioning them in the local paper. Anne gave them resources for continuing their education in whatever direction interested them.

The gratitude expressed by the students made Anne feel amazing. Her passion to help people in a meaningful way had been stoked and now there was no suppressing the burning drive within her. She wanted to offer these activities to other community colleges and grow into other personal finance areas of interest. A few simple money management activities for college students had already changed many lives for the better.