How to Design Financial Literacy Games for College Students

If you’re looking for guidance on how to design your own financial literacy games for college students, you’ve come to the right place. Look through our resources and you’ll be inspired to build your own financial literacy programs.

You’ve discovered the National Financial Educators Council (NFEC), an independent organization that provides everything you need to create financial literacy games. Our certified financial education instructors know how to get through to people of all ages and backgrounds. Our fun, engaging money management games will inspire your students to improve their financial behavior.

The Seed of an Idea to Build Financial Literacy Games for College Students

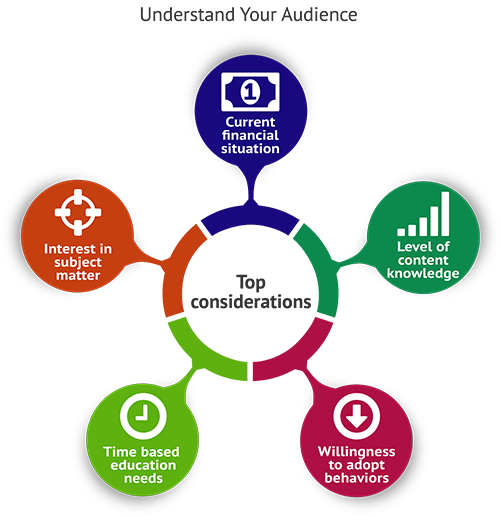

Polling his students revealed a strong desire to learn about personal finance in college. The financial literacy survey he provided to students gave him great insight into the topics important to them.

How Well Do College Students Need to Understand Personal Finance?

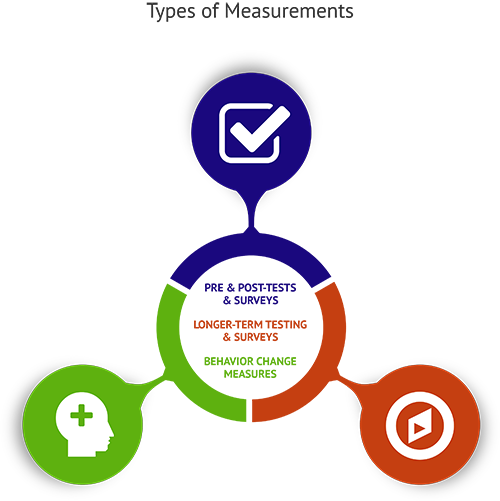

Under the guidance of the NFEC, Percy started by defining the learning outcomes he wished for his students and picked out financial literacy test questions he thought would best help him measure student progress toward those goals. Ideally, he wanted participants to walk away with strategic thinking skills but given the time constraints, he’d be happy if they got to the stage of understanding the skills and concepts of personal finance.

Delivering Financial Literacy Games for College Students

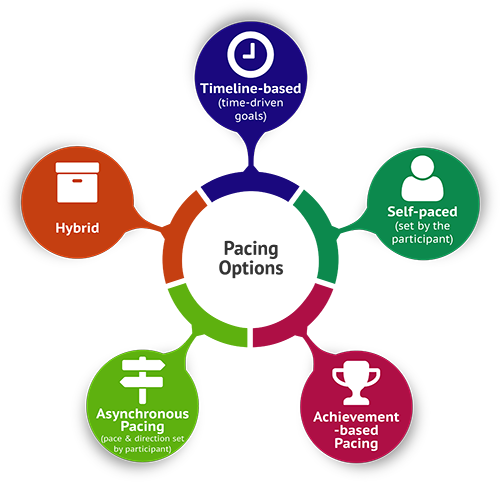

Now that the short-term goals and long-term objectives were defined, Percy considered an appropriate delivery method that college students would respond to. A timeline-based program would fit nicely into the college curriculum and a bi-weekly in-person instruction would keep students engaged. An online forum would allow the participants to help each other and offer support beyond the instructor.

Appropriate Financial Literacy Topics for College Students

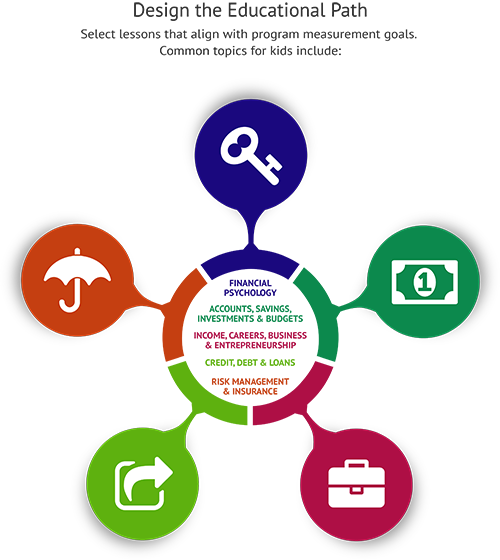

Now to decide on specific subjects that would speak to college students and have an immediate positive impact on their lives. They certainly needed to know about college financial planning and how to plan a career. Percy also wanted to make sure they understood the fundamentals of budgeting and the perils of debt. Focusing on these topics alone, would allow the students to reach the level of strategic thinking that Percy intended for his financial literacy games for college students.

Important Aspects of a College Curriculum Teaching Financial Literacy

Percy wanted the financial literacy class to be engaging and interactive. What good were financial literacy games for college students if it didn’t teach them real-world skills that they could apply to their lives right away. The program also had to meet core financial education curriculum standards and be independent of the influence of investors. The financial literacy games also had to be based on learning principles derived from empirical evidence. A strong scaffolding would also help.

Who Would Present Percy’s Financial Literacy Games for College Students?

Even though Percy wanted to become a certified financial instructor someday, that would have to wait. Right now, designing and implementing his first course and getting the college students engaged in financial literacy activities was his focus. Therefore, he needed to find the right presenter for his financial literacy games.

Thanks to the NFEC, he found the perfect person for the task. The NFEC Certified Financial Educator had plenty of success in educating college students about financial literacy through games. She was personable and relatable. Her lively presentation made the games that much more fun. She was even local, so she could present in person and be around for office hours, just like Percy had planned.

Results of Percy’s Financial College Games

26 college students signed up for Percy’s program and 23 finished. Percy was thrilled at the 88% completion rate. All the students who completed the financial games expressed a desire to learn more. They wanted deeper knowledge and knowledge of advanced topics.

Percy needed to create a report that would highlight the program’s success. He sorted through the data and created the report, which he would show to potential investors. He would also use it to gain community support.

The Future of Percy’s Financial Literacy Games

Percy kept the forum open, so the students could continue to support each other and access the teacher. He awarded completion certificates along with instruction on how to use them to get better jobs and on college applications.

Percy’s financial literacy games for college students were a success by all measures. Now he wanted to expand into other regional areas and get into more advanced topics of personal finance.