Financial Literacy for Middle School: Some Ideas about Best Methods

If you have an interest in presenting lessons in financial literacy for middle school, there are some recommendations for making the instruction most successful. The information on this page can be helpful to get people started in the right direction toward teaching strong financial literacy for kids.

How to Adapt Financial Literacy for Middle School Students

Teaching financial literacy to middle school ages should be adapted to fit their unique needs and abilities. This time in their lives represents a teachable moment for shaping their money management skills in a positive way that can have powerful effect on their futures.

Children come into this world as members of a given family with a singular financial situation. That is, every family’s financial makeup is different, and that situation has major impact on the habits the children develop. The parents’ socio-economic status, the spending and saving behaviors they demonstrate, and how money affects their emotions – all these make a difference in their kids’ future finances.

While children grow up, they are exposed to the full gamut of factors that will influence their financial behaviors. Marketing is a huge piece of that puzzle. For example, the American Psychological Association recently linked food industry advertising targeted toward children with increased childhood obesity. https://www.apa.org

Further, middle school financial literacy programs should consider the financial sentiments that parents model and children pick up. Everyone has an individualized set of feelings and attitudes about money. As kids are exposed to information regarding how others feel toward money, they start developing their own emotions about the topic. And this emotional base has impact on future money management for kids.

The essence of financial literacy for middle school is to incorporate financial lessons into the curriculum. Yet few schools are teaching this important subject, and parents frequently lack the knowledge and time to teach kids themselves. Instruction that includes financial behaviors, psychological factors, and practical systems is much-needed in today’s school systems.

Question for Middle School Financial Literacy Teachers: What is their Learning Level?

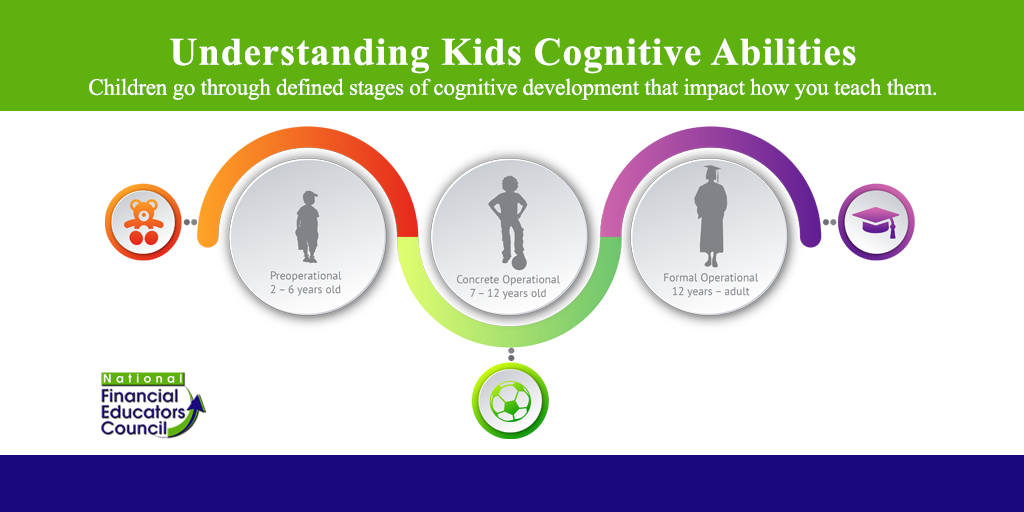

It’s important to comprehend the cognitive stage of the student audience when you start teaching personal finance lessons for middle school kids. Middle schoolers generally are aged 11 to 14. That means the younger ones may fall at the concrete operational phase in Piaget’s cognitive acquisition theory, which is a good time to offer them logical problems about concrete events. For example, you might ask them to solve relational numerical calculations of more versus less, or consumption versus production. They should be able to grasp volume and mass, and comparisons between currency values. The middle school financial literacy lessons for the older students must take into consideration that they’re at the formal operational level. Thus they may benefit from abstract problems they can solve as a group. Brainstorming solutions to financial difficulties encountered by imaginary characters may be a valuable lesson and practical, enjoyable process for these students. Kids at this age also appreciate technology, and may enjoy online games and apps for learning.