Personal Finance Online Course Leverages Best Practices, Life Skills

Introducing the National Financial Educators Council’s personal finance online course: eVolve, a dynamic and authentic platform that shows off best practices in eLearning to their strongest advantage. The NFEC offers the state of the art in free online personal finance courses – providing age-appropriate and practical education that can be leveraged via self-study, live instruction like workshops or camps, and/or blended settings.

eVolve gives flexible options for both participants and instructors, with ability to accommodate a variety of scheduling and format choices. In addition to leveraging educational best practices, the personal finance course online content also meets common core standards. Thus this program represents much more than simply education; it offers real-world training so participants raise their capabilities to handle money decisions throughout life.

Free Online Personal Finance Courses have Striking Features

Creating an exciting and interactive user experience was a top priority during eVolve’s development. The NFEC accomplished this objective by incorporating striking features in its personal finance online course including gamification (points, bonuses, badges, etc.), simulations, and a vivid visual design. Based on the notion that the best personal finance online course is one that can accommodate both asynchronous and synchronous activities, eVolve features include flexible learner options that help them mold and modify their financial behaviors. The instructional methods are firmly grounded in the educational theory of constructivism, adopting a learner-centered focus that leverages appropriate scaffolding and uses practical case study and scenario-based instruction to maximize retention and practicability.

Best Online Personal Finance Course Includes the Financial Life Guide

Going well beyond simple education, eVolve walks participants through activities that guide them to build sound financial foundations. For example, every student completes the Financial Life Guide, a step-by-step project-based learning tool that has learners define their goals and plans across each specific life stage. They come away with an individualized financial plan with built-in educational reminders to which they can refer back throughout their lifetimes. Such practicality in teaching has been identified in current research as one of the qualities of award-winning instruction. The Financial Life Guide used in this personal finance online course takes learners through the following real-life planning steps:

Use Personal Finance Online Course in Flexible Ways

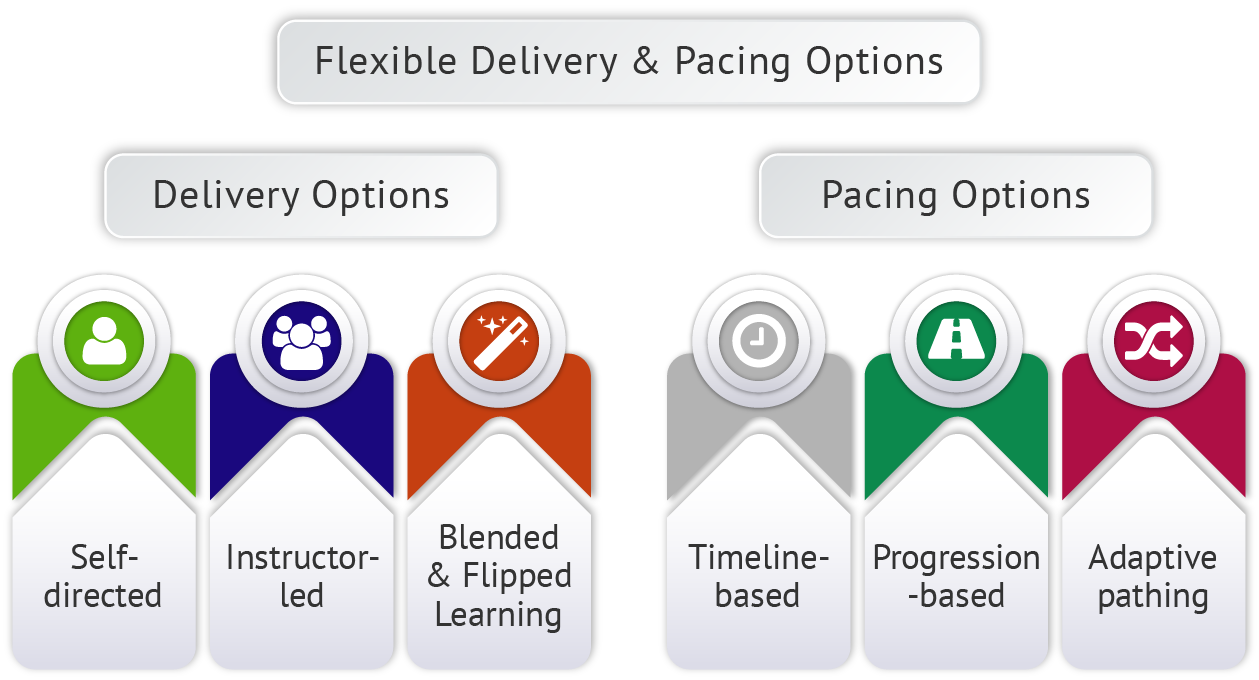

The eVolve financial literacy online course program is not just evidence-based, it’s highly flexible to meet different pacing and delivery needs. Give learners a self-study agenda, with automatic notifications when the next lesson becomes available and accountability features to ensure lesson completion. Instructors who want to teach live events will find the resources they need. Alternatively, eVolve instruction can be blended to include both in-person and online teaching.

In regard to pacing, depending on the schedule, these money management lesson plans allow lessons to be released on a timeline. Or use the progression-based features to block student progress until they complete lesson tasks and tests. These free online personal finance courses can be targeted to adapt when students have trouble with a lesson – redirecting them to a review module that presents the topic differently.

Learning Management System for Free Online Personal Finance Courses

The robust Learning Management System (LMS) that supports eVolve has features for participant management and performance measurement. The LMS can be integrated with other technology using a built-in TIN CAN API to combine activities from different programs. The API records data that track the learning experiences in which students participate. For instance, one important activity eVolve guides learners through is the Financial Life Guide. This activity elevates participants to higher levels of knowledge as they work through a full financial plan to guide their personal finance decisions throughout life.

Students can refer back to this Financial Life Guide at every stage in the lifecycle, enabling this personal finance online course to achieve its goal of helping participants work toward a state of financial wellness.