Don’t Underestimate the Power of a Financial Literacy Quiz

How do you know if your financial literacy education program is a success, if you don’t measure and track the students’ progress? Not testing is like trying to set a speed record without a stopwatch. A financial literacy quiz system will guide your program to maximum success by pointing out possible weaknesses you might not have seen.

Quizzes and tests are a standard part of the NFEC’s curriculum. They are an essential evaluation tool for educational programs and individuals interested in learning more about finance. Start today. Just pick your subject matter, take a test and reviewed the emailed results.

Strategic Financial Literacy Quiz Answers Uncover Hidden Obstacles

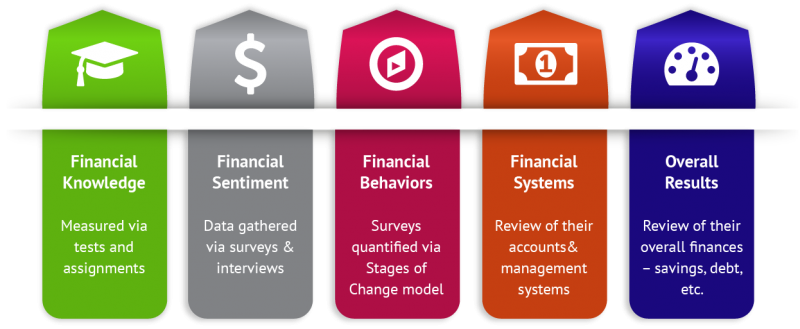

The answers to our strategic quizzes reveal more than just financial knowledge. They measure long-term success of a program by tracking students’ progress after the class ends. The curriculum has learners design personal financial systems to be implemented one step at a time after completion of the course. Measuring the financial situation of students before and after a financial course is the ultimate determination of success.

We also measure deep personal aspects of personal finance. These factors are often unconscious and can be the difference between success and failure. If a person has a negative internal association with money, that person might never implement increased knowledge of personal money management techniques. If a person treats money poorly, their behavior might sabotage conscious efforts toward financial wellness. All financial literacy classes should consider the behavioral side of personal finance.

Can You Find Financial Literacy Quiz Answers in a PDF?

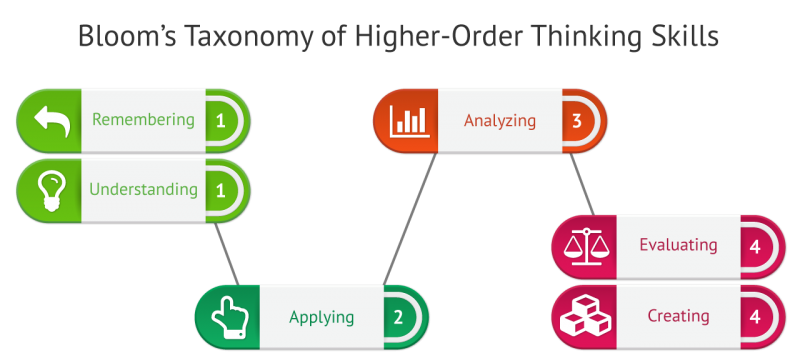

A simple financial literacy quiz pdf can answer the question of how deeply the students are grasping the knowledge. We measure this on scales of Bloom’s Taxonomy and Webb’s Depth of Knowledge. If a student doesn’t understand how to apply basic skills and concepts, they can’t be expected to strategically analyze the material. If a course tries to teach advanced phases of learning before the basic is mastered, students will get frustrated and lose interest. That’s why measuring the depth of understanding is critically important to the program’s success.