Money Coach Salary

To generate these data, we define money coach salary as any position open for a person to serve a coaching role by first understanding their clients’ financial goals and situations, and then providing support and accountability, as well as education and assistance to guide them toward financial health and security. A money coach has a fiduciary responsibility to their clients. They do not sell financial services; but support them on their path toward financial wellness.

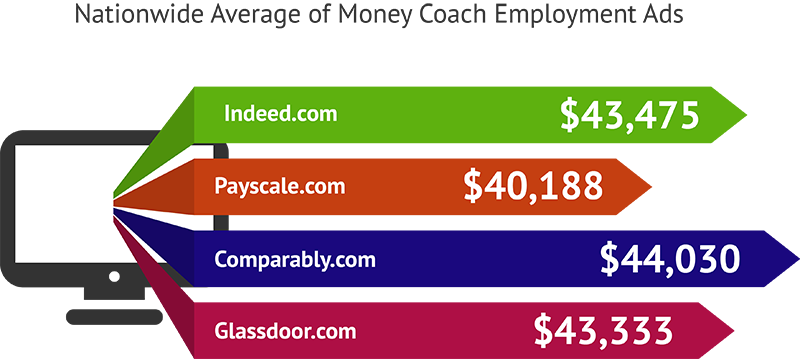

The data were compiled from national results on top job sites, gathered by searching terms related to money coaching job opportunities and what roles a money coach fulfills. It was noted that a money coach salary is higher in cities. ZipRecruiter, for example, estimates average salary of a money coach in metropolitan areas to be $66,000, over 35 percent higher than the average for rural areas.

Who Hires Money Coach Employees?

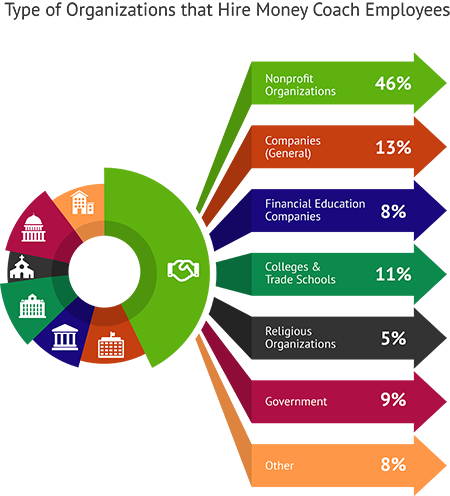

Relevant searches on ZipRecruiter, LinkedIn, and Indeed websites yielded the following data related to the term ‘money coach’, ‘certified money coach‘ and similar terms. Any sellers of financial instruments – such as financial service organizations – were excluded from the results.

We observed some common position types requested, with most centering around three areas: general personal finance for internal personnel, general personal finance for community members, and specific financial topics (such as state retirement plans).

6 Tips to Build Money Coach Earning Power

Money coaches can take strategic steps to boost their earning power. Those looking into starting a financial coaching business should adhere to these six tips for increasing a money coach income:

Experience

Get experience with clients and write case studies about their achievements.

Training

Obtain training to get certification and additional credentials.

Reporting

Develop measurement and reporting skills to showcase your capabilities and demonstrate client successes.

Technology

Stay abreast of updates to the available coaching tools and technology, so your skills remain cutting-edge.

Image

Develop a highly-visible and professional online presence and image.

Commitment

Communicate your passion for helping others and your commitment to providing your clients with excellent service.

Other Opportunities: Entrepreneurial Endeavors

The 137 financial coaching websites appearing in the top 50 Google results were reviewed for keywords that included the term ‘money coaching.’ A total 26 websites met the search criteria. A wide variety of coaching packages were available, with pricing from a few hundred up to $6,000. Packages were the most common offering, provided by 21 of the 26 sites. Packages varied in scope, but all included personal coaching contact and were based on time (by the month, quarter, or year).

Hourly pricing was used to compare across sites because of the package variance. Twelve of the 26 sites offered hourly pricing. Other methods of pricing were based on reaching specific goals, like budget makeovers, better credit scores, or support with a specific financial decision. One website found would have problems with the SEC because they stated they “provide investment advice” – not permitted for unlicensed coaches or investment speakers that do not have the proper licenses.

What Money Coaches Offer

On the websites we reviewed, the most common service money coaches offered (all 26 sites) was one-on-one contact with the coach – most often by phone, but some had email options. Of the 26, five offered custom personal financial plans to clients. Two sites had re-planning and reporting services, including adjustments to the initial plan and separate reports with new data. Educational materials were offered by 8 of the 26 (in any form, such as coursework or ongoing training).