Certified Housing Counselor Programming Satisfied by the Certified Personal Financial Wellness Consultant Training

A specific NFEC Certified Housing Counselor training program may be offered soon. In the meantime, the Certified Personal Financial Wellness Consultant programming currently available has a long track record of preparing people with the credibility, expertise, and self-confidence to effectively counsel clients across a broad range of personal finance areas.

The NFEC designed its NFEC Financial Coach certification program while keeping in mind the variations between clients based on the individuality of their money-related habits, relationships, attitudes, and behaviors. The training addresses both skill-building and experience so graduates are competent to obtain the best possible results with their counseling clients. Housing counselor certification programming, when in place, will have similar goals.

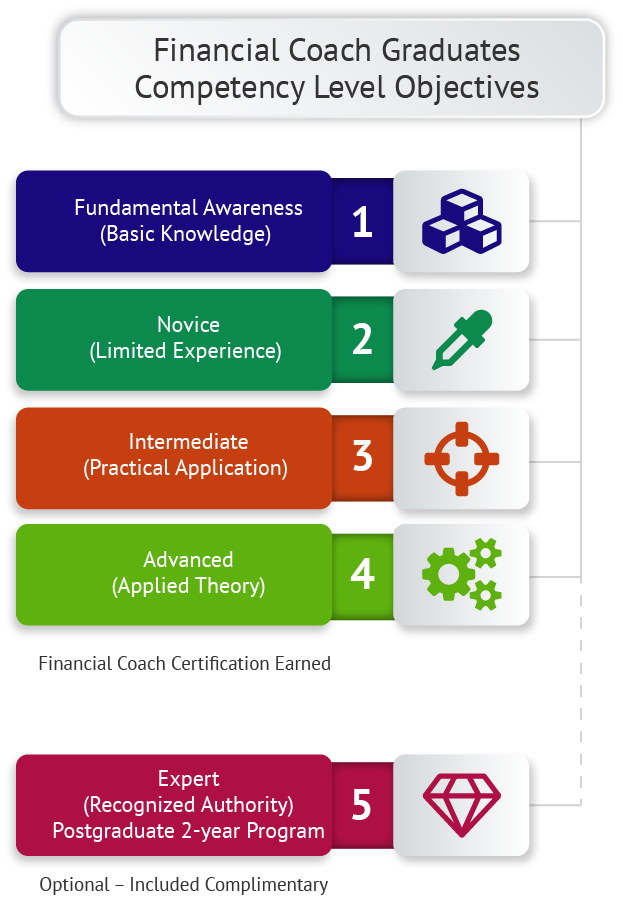

NFEC Financial Coach Objectives for Competency Targets

The competencies for the NFEC Certified Housing Counselor program will be similar to those set in place for the existing NFEC Financial Coach training, which empowers graduates with capabilities and systematization to provide the utmost service to the clients they counsel. NFEC Financial Coaches are well-qualified to work toward improving the financial health of both individuals and communities.

The Certified Personal Financial Wellness Consultant training package is highly rigorous, yet practical in that it includes experiential components to enable participants to practice their counseling skills. Graduation is achieved after completion of 180 hours of training and implementation – representing 18 CEUs – and earning an 80%+ score on a challenging final test.

This rigor means that NFEC Financial Coach graduates have proven aptitudes as financial counselors, as measured by the Competencies Proficiency Scale developed by the National Institutes of Health. Further, the NFEC provides continued support to its certified counselors, so they become the go-to authorities for financial counseling in their communities.

Topic Content in the NFEC Financial Coach Training

To help counselors become skillful and achieve maximum effects, the NFEC Financial Coach training covers a range of personal finance topics along with principles of counseling and psychological theory. The material is presented not only as written lessons, but also using active digital learning features.

Chapter Components of the NFEC Financial Coach Program:

Obtain Real-time Counseling Experience

Would you take legal advice from an attorney who got a law degree from YouTube? The same is true for a financial or housing counselor – clients won’t trust them unless they’ve proven their ability to provide financial counseling to others, and shown that they’ve achieved positive outcomes.

The NFEC Financial Coach training builds trust in your abilities by incorporating application and practice of counseling skills so you learn the best ways to serve clients, gain confidence, and make an excellent impression on your prospective customers.

Four Types of Experience Training in the NFEC Financial Coach Program

Guidelines for Qualifying NFEC Financial Coach Financial Counselors

Since the NFEC has already developed guidelines for how NFEC Financial Coaches must be qualified, the same rules will be in place for the NFEC Certified Housing Counselor training as for the financial counseling classes. These guidelines focus on the tenet that – first and foremost – the counselor is responsible as fiduciary to the client. A dozen-plus high-level agencies were tapped into to guide the development of these standards, among them FINRA, the SEC, the FTC, and the American Psychological Association.

The NFEC took a proactive stance to set forth these guidelines because ensuring that NFEC Financial Coaches have only the best qualifications offers protection to both clients and counselors. The benchmarks are comprised of a teaching framework guided by current educational theory to ensure top quality and effects; common language to facilitate good communication; and awareness-building features to let people know how important it is to choose counselors with optimal credentials.

Not Just Skills – Resources and Processes Too

A NFEC Financial Coach – as distinguished from the run-of-the-mill certified housing counselor, which you can learn about on the HUD website – earns entrée to the highest quality of counseling/educational resources and process systems to counsel clients effectively. And the training includes hands-on preparation in how to use all these tools.

At each stage of the counseling experience, there are built-in materials offered in the training – the same materials you’ll use when you become a practicing counselor. This structure enhances your understanding, builds your skill, and demonstrates real-world application of the tools. The NFEC Financial Coach resources comprise:

Upwards of 100 Training Videos

Weekly Webinars, Live and Optional

Coursework Handbooks & Guides

Genuine Certification Award

Business Resources Incorporated

The NFEC subscribes to the belief that, to achieve success, NFEC Financial Coaches must have not only skills training, but also business-related resources to help them launch their consultation practices. Here are the business resources included:

Business Plan Templates, Training, and Materials

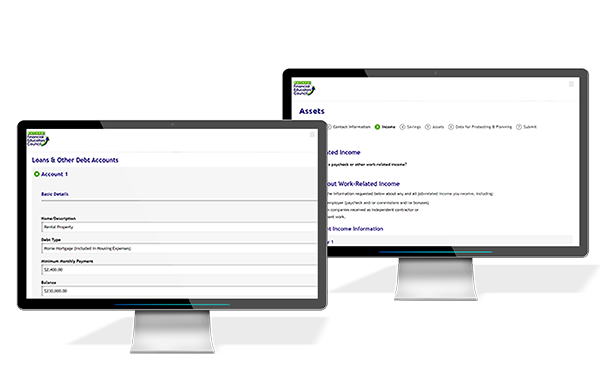

Proprietary Counseling Software Platform

Processes & Communications for Effective Counseling

Forms and Counseling Practice Resources

Client Financial Education Resources – eLearning center, handouts, PDFs, curriculum

Marketing Promotions & Client Leads

Packages & Pricing