What is a Financial Coach & What do Financial Coaches do?

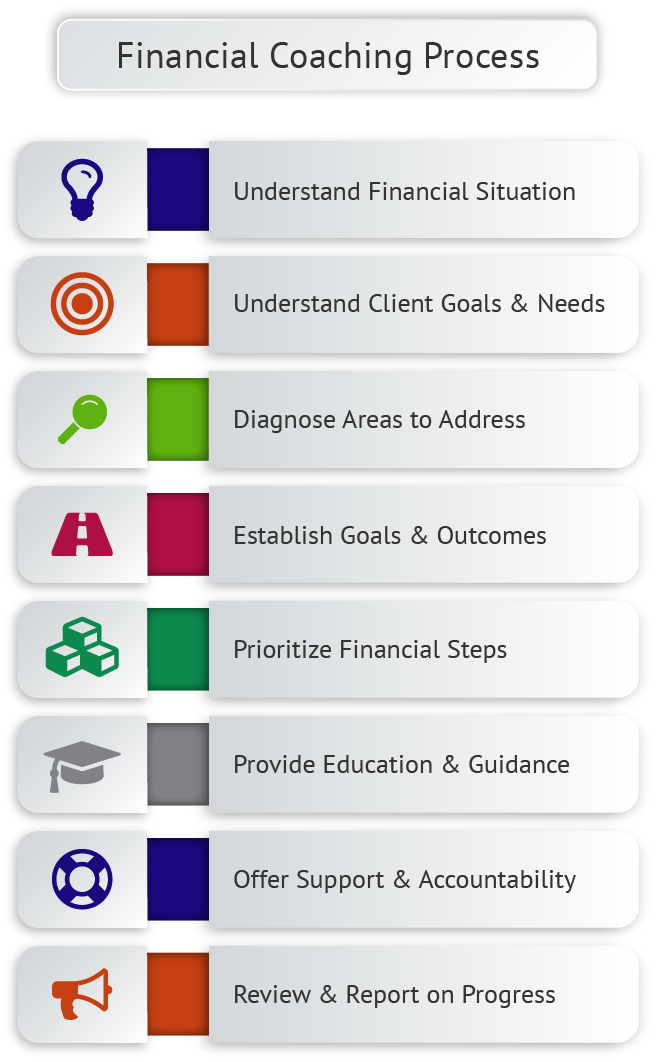

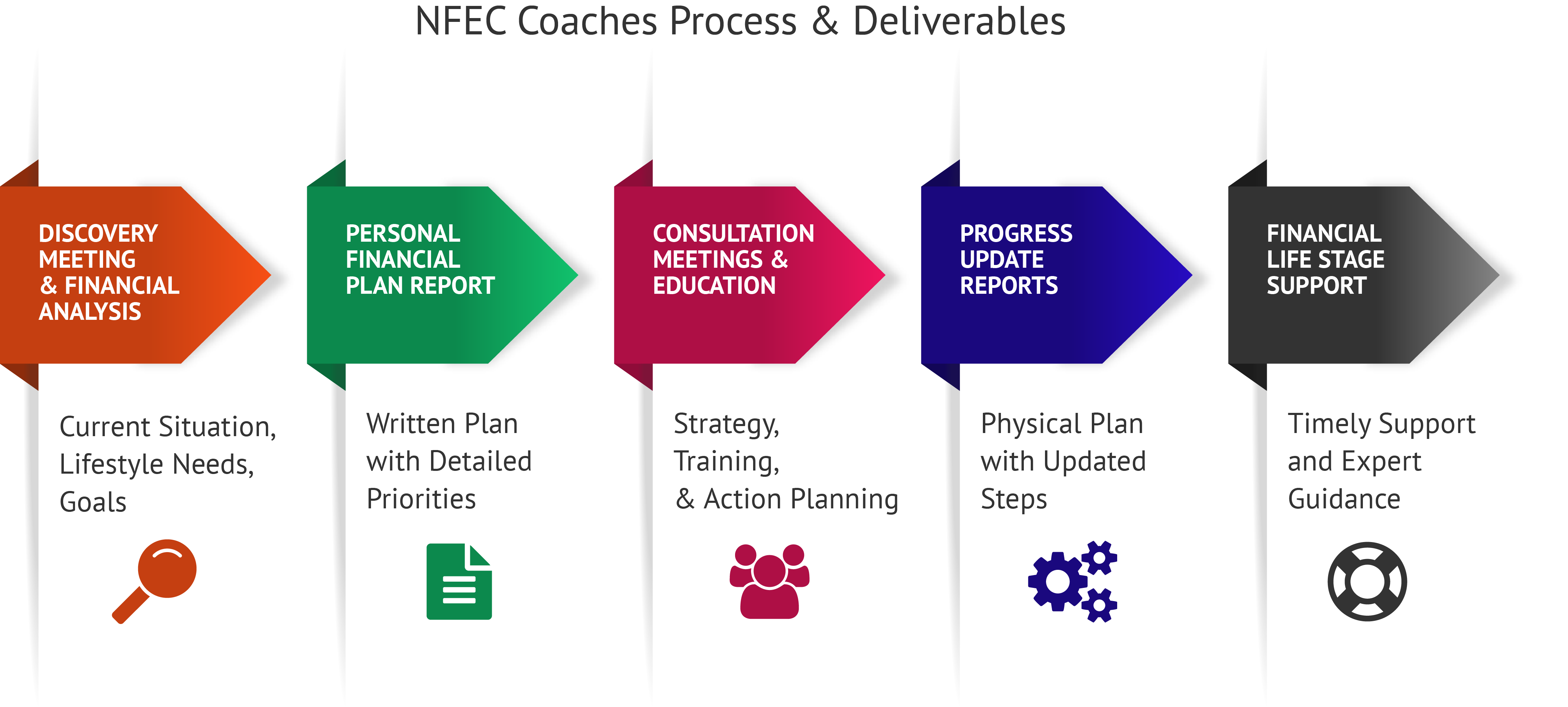

The term “financial coach” refers to a professional who works to understand a client’s current situation by conducting empirical analysis of the client’s finances; uncovers their goals and needs; defines clear objectives for the client; prioritizes steps; provides education, guidance, and accountability; and supports clients to work toward a state of financial wellness and security.

Thus a financial coach’s role is to offer education, tools, resources, encouragement, and monitoring – not financial advice. Rather than telling clients what to do with their money, financial coaches give clients information, support, and tools so they can make their own qualified money management decisions.

So what is a financial coach? Continue reading to understand the coach’s role, process of coaching, and standards coaches must meet.

What Financial Coaches do to Serve Clients

A coach’s main role is to empower clients with the knowledge, skills, and confidence they need to make qualified financial decisions. Their objectives are outcome-based; that means the primary goal is to improve the client’s financial situation.

What Financial Coaches do Not do

To get a clear definition of what a financial coach is, it’s equally important to understand what financial coaches are not. Financial coaching is not meant to be a therapeutic relationship or crisis management service. Coaches provide encouragement and monitoring, rather than advice. The behavior change process should be client-driven and designed to help clients work toward reaching their stated goals.

It also should be noted that a personal financial coach is not an investment advisor. The Securities and Exchange Commission offers a clear and binding definition of investment advisors: persons or firms that are “engaged in the business of; providing advice to others or issuing reports or analyses regarding securities.” So financial coaches do not recommend stocks or other investments.

Process Financial Coaches Use to Support Clients

What is a Financial Coach’s Set of Qualifications?

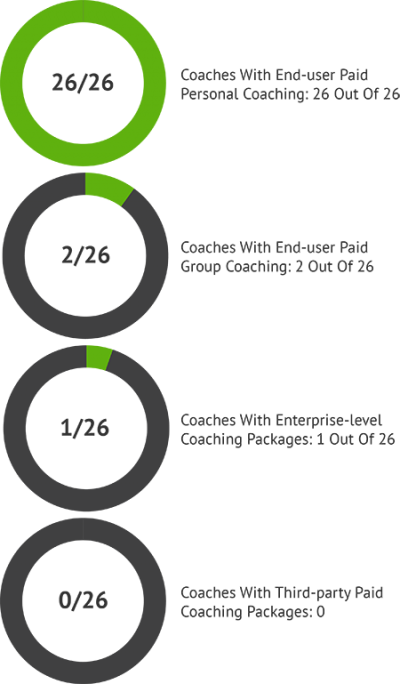

Anyone can set up shop as a financial coach. But NFEC Certified Personal Financial Wellness Consultants must comply with the highest level of experiential, educational, and background criteria. So what does a financial coach do to meet these criteria? NFEC coaches have completed their financial coaching certification and must comply with strict obligations including hundreds of hours of education, demanding tests, and supervised implementation and performance evaluations. The NFEC created its standards with direction from four industries: 1) counseling psychology, 2) coaching, 3) consumer and financial protection, and 4) education, specifically financial education. These industries help inform standards for coaches, who must deal with the emotional subject of personal finance; and give clients education, accountability, and guidance toward financial wellness.